Employer Fica And Medicare Rates 2025 Lok - 2025 Wsop Schedule Las Vegas. Thursday, february 9, 2023 to thursday, february 23, 2023. 2025 55th annual world series of poker schedule. The 2025 world […] Employers must match this tax as well. Budget 2025 expectations live updates:

2025 Wsop Schedule Las Vegas. Thursday, february 9, 2023 to thursday, february 23, 2023. 2025 55th annual world series of poker schedule. The 2025 world […]

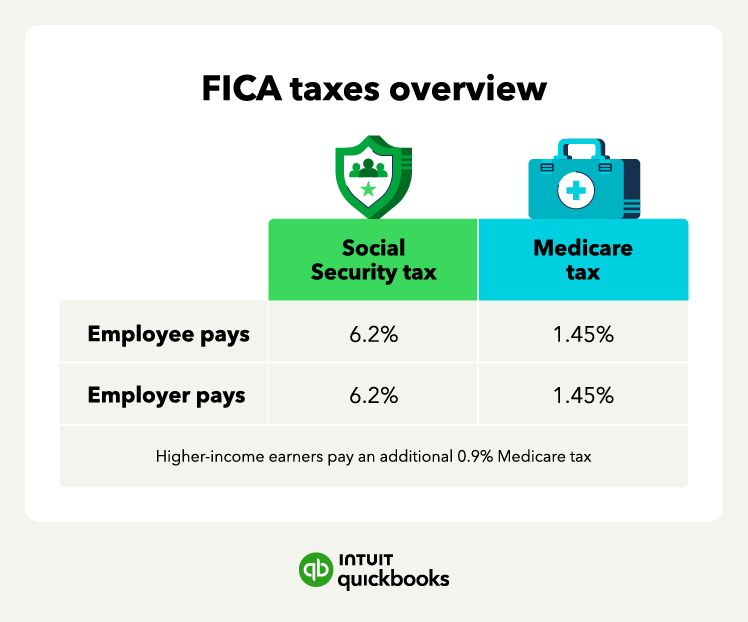

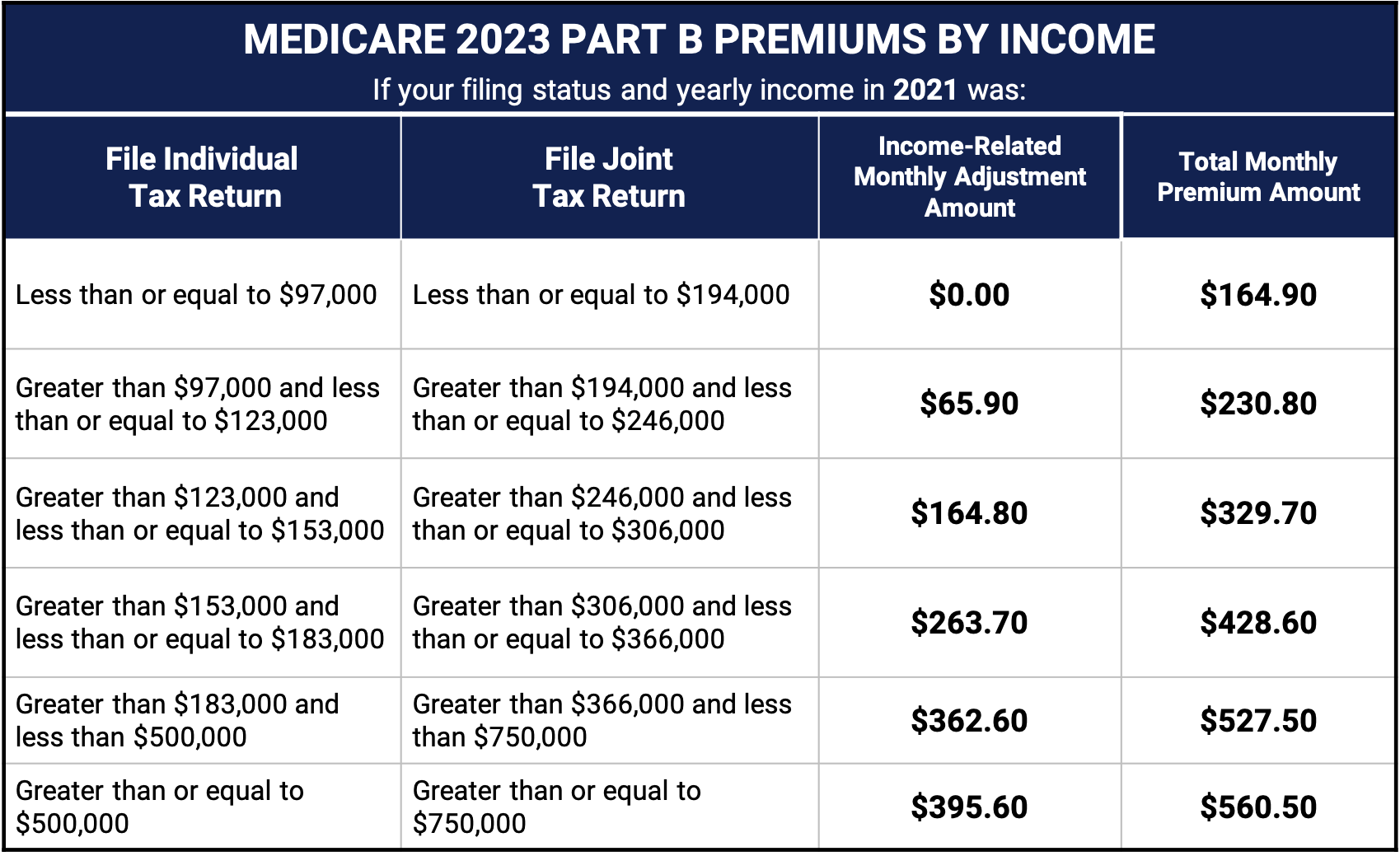

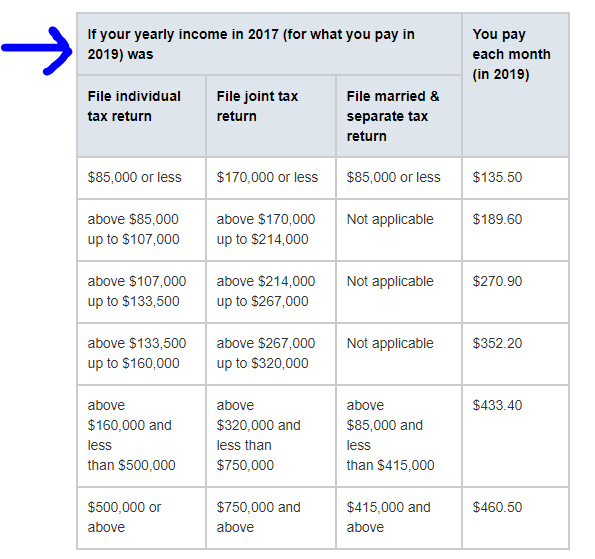

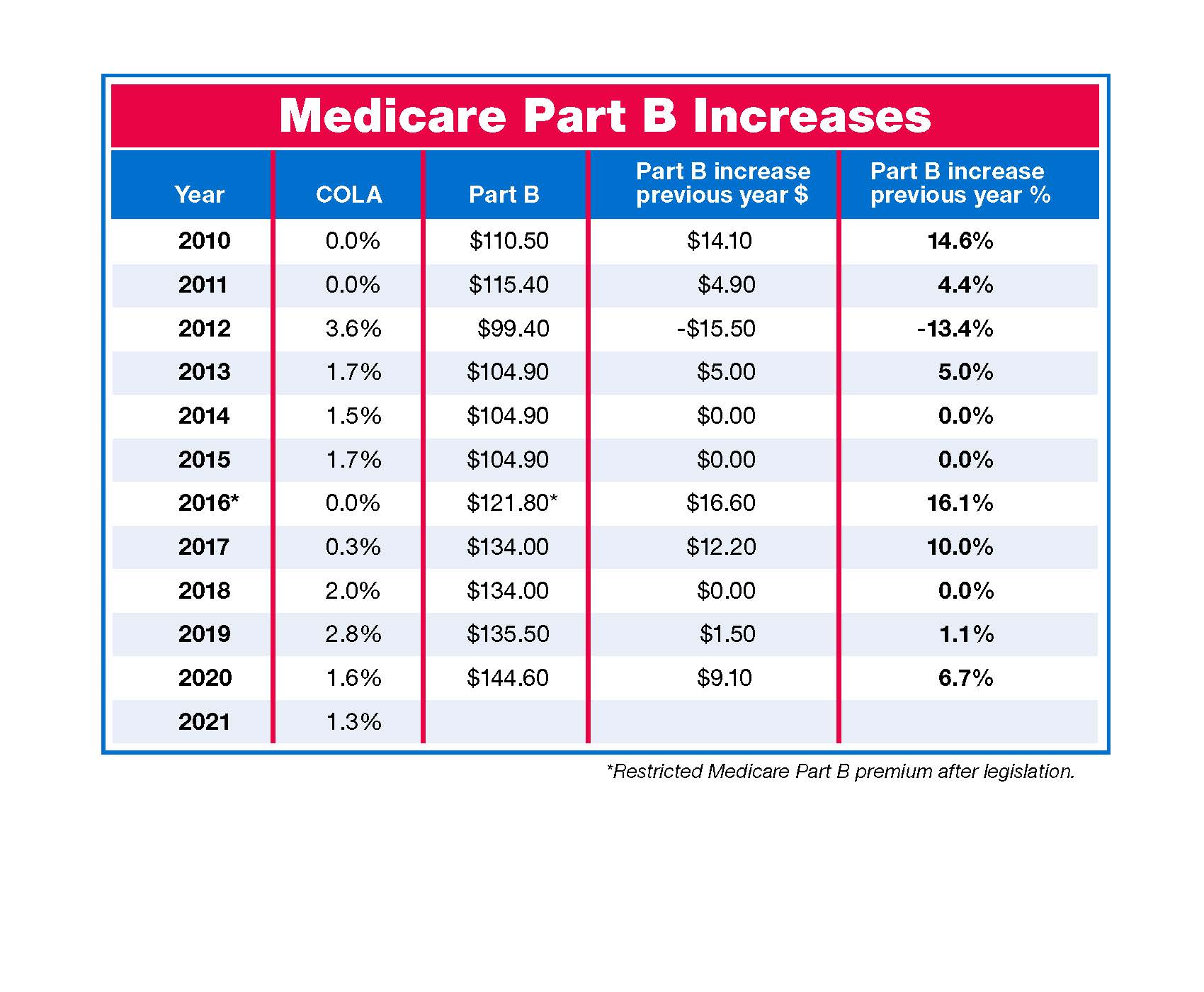

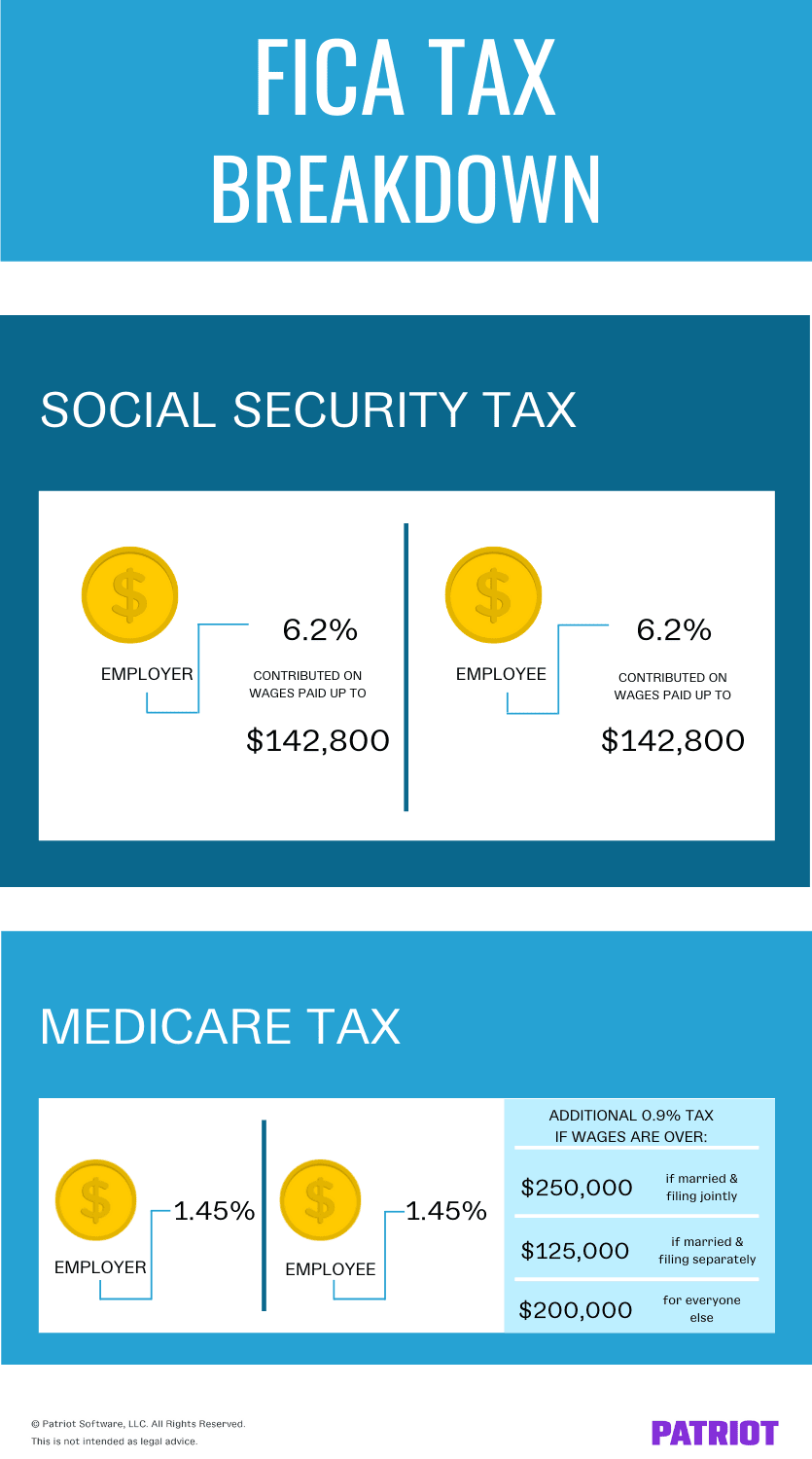

Medicare Agi Limits 2025 Berti Konstance, What is the employer fica rate for 2025? In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023.

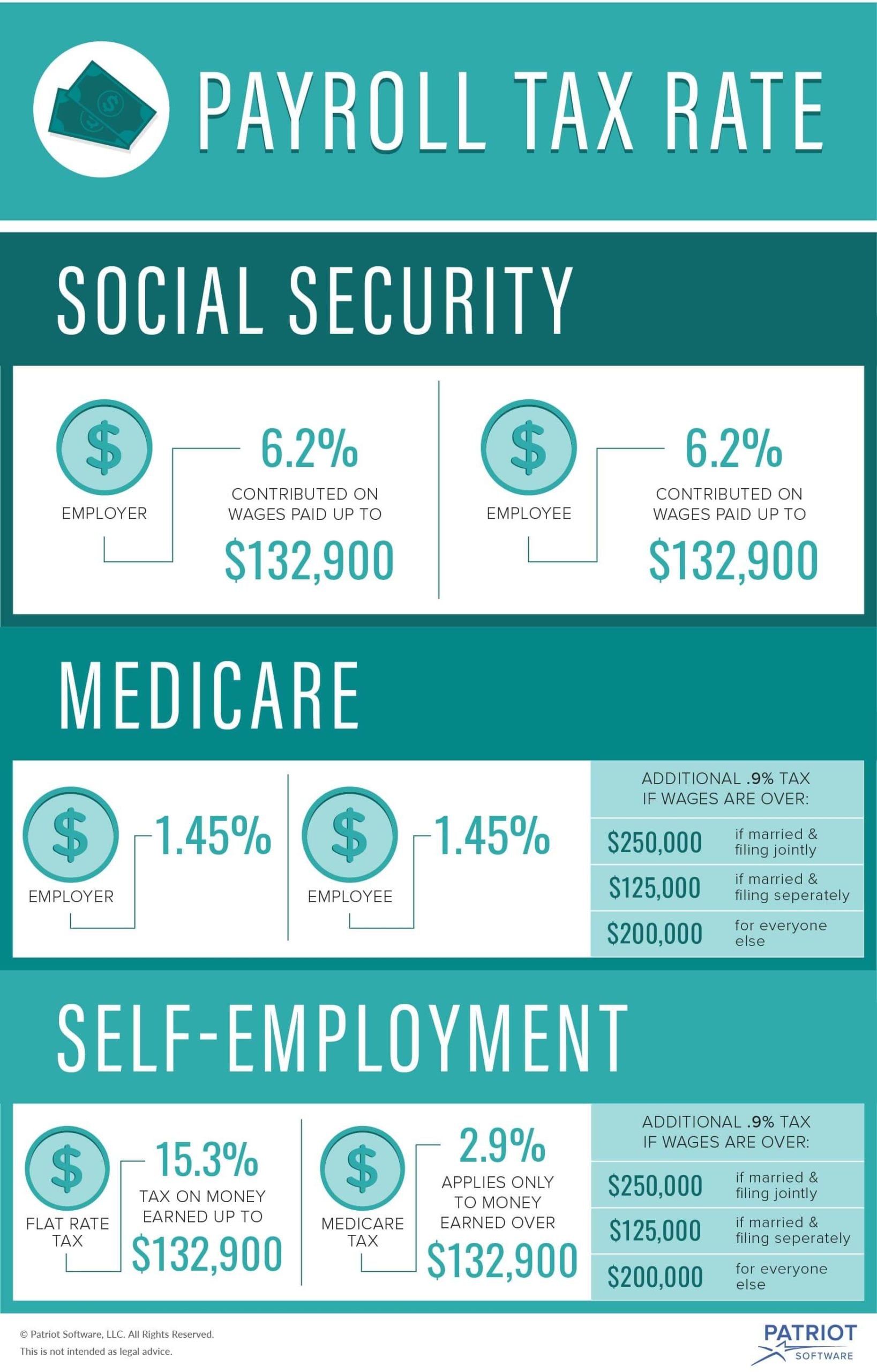

Understanding FICA, Social Security, and Medicare Taxes, Under fica, you also need to withhold 1.45% of each employee’s taxable wages for medicare. In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee and the other half (1.45%) paid by the employer.

How Much Is Fica 2025 Abbey, Fica stands for the federal insurance contributions act, and it’s. To calculate fica (federal insurance contributions act) taxes in the united states, which include social security and medicare taxes, follow these steps:

How Much Is Medicare Deductible For 2025 Anthe Jennilee, As you can see, the employer’s portion for the social. With this in mind, understanding employer match is key.

Fica And Medicare Tax Rates 2025 Adara, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). Stay informed on employer updates, individual shifts, and federal regulations.

For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively.

What Are Fica And Medicare Deductions, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023.

What Is The Medicare Tax Limit For 2025 Grete Verile, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively.

What Are The Current Fica And Medicare Rates, Fica taxes owed by the employer: Under fica, you also need to withhold 1.45% of each employee’s taxable wages for medicare.

Employer Fica And Medicare Rates 2025 Lok. 1.45 percent medicare tax (the “regular” medicare tax). Medicare tax rate for 2025: